Options Engine Contract Calculator

Save time and energy analyzing options trades

The Options Engine extension automatically calculates additional relevant information to supplement the Yahoo Finance options chain tables.

Repetitive Calculations For Your Options Contract Analysis

Options Engine does repetitive calculations for you to help you analyze potential options trades.

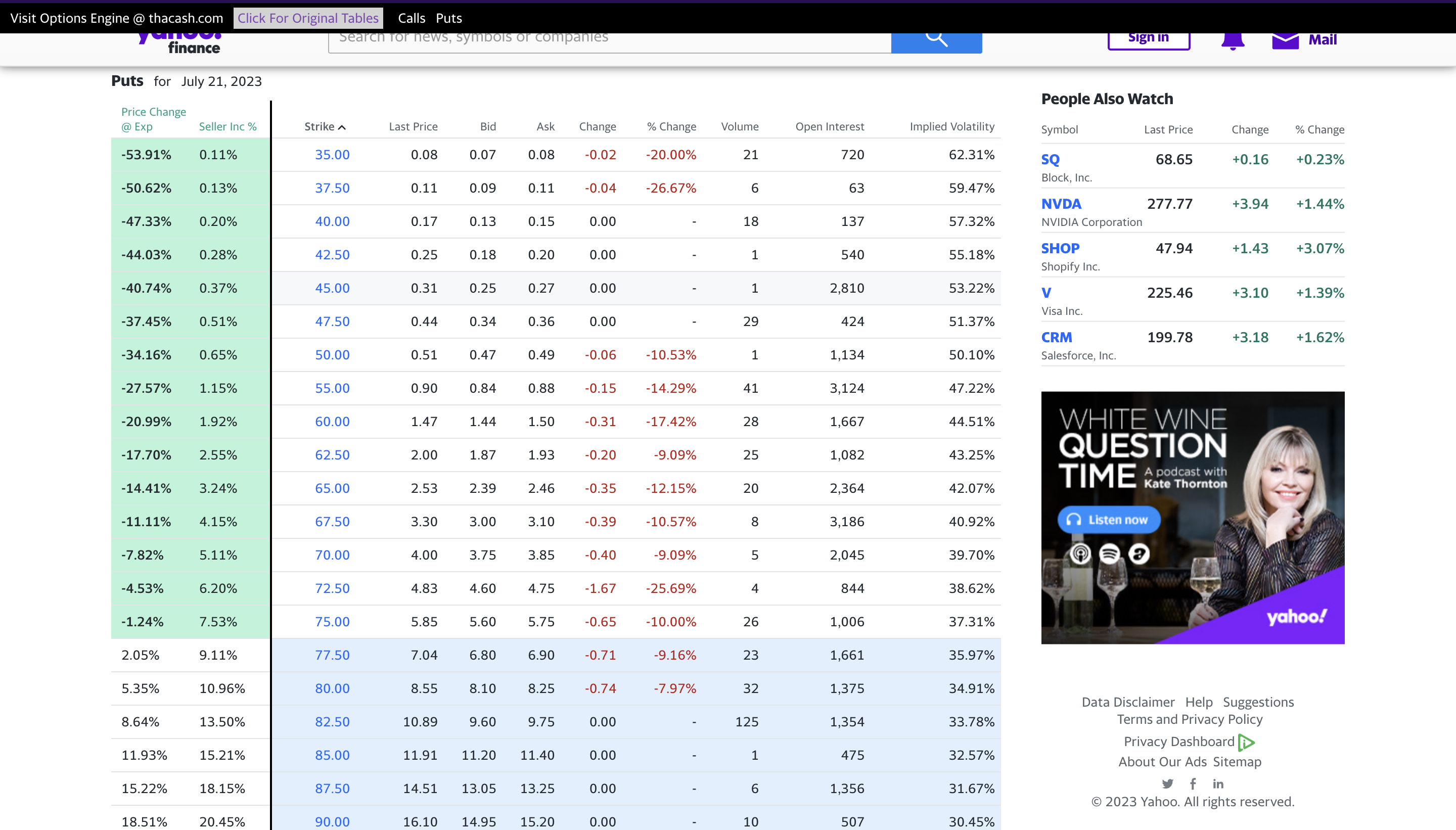

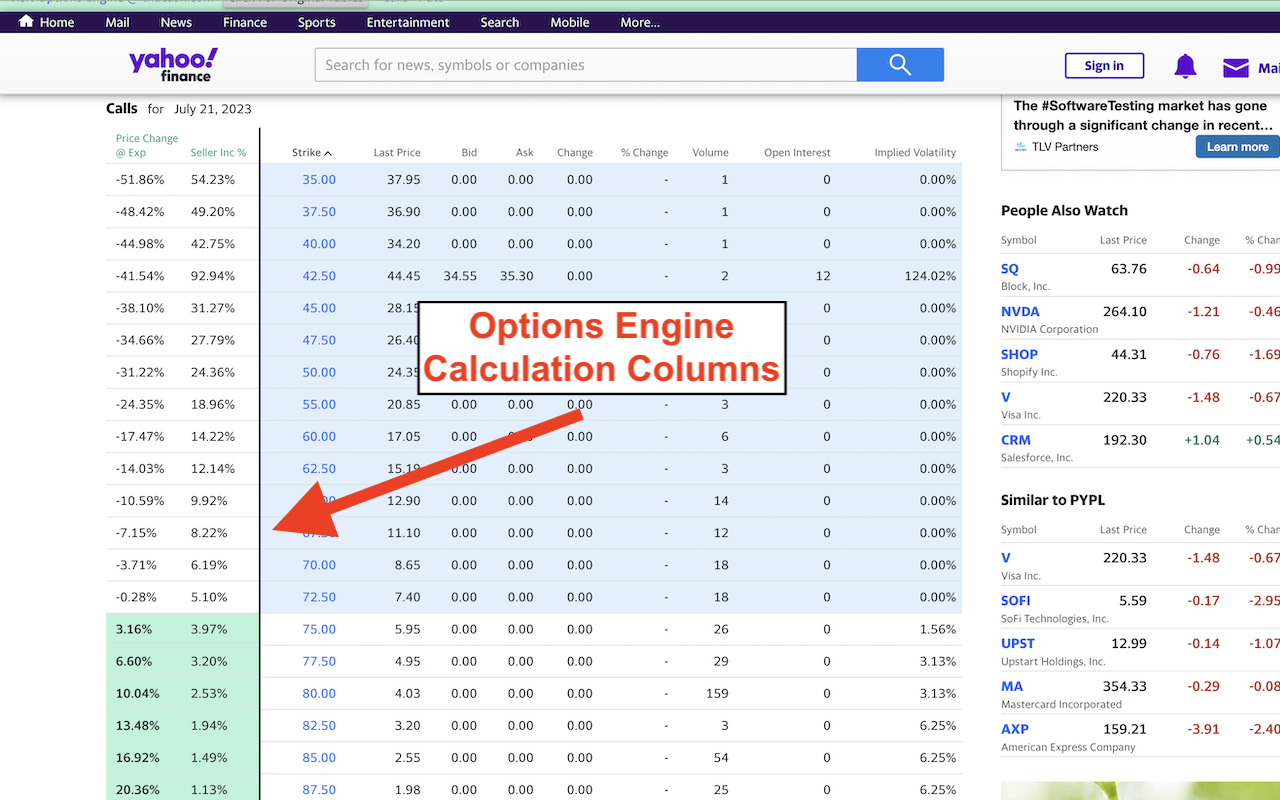

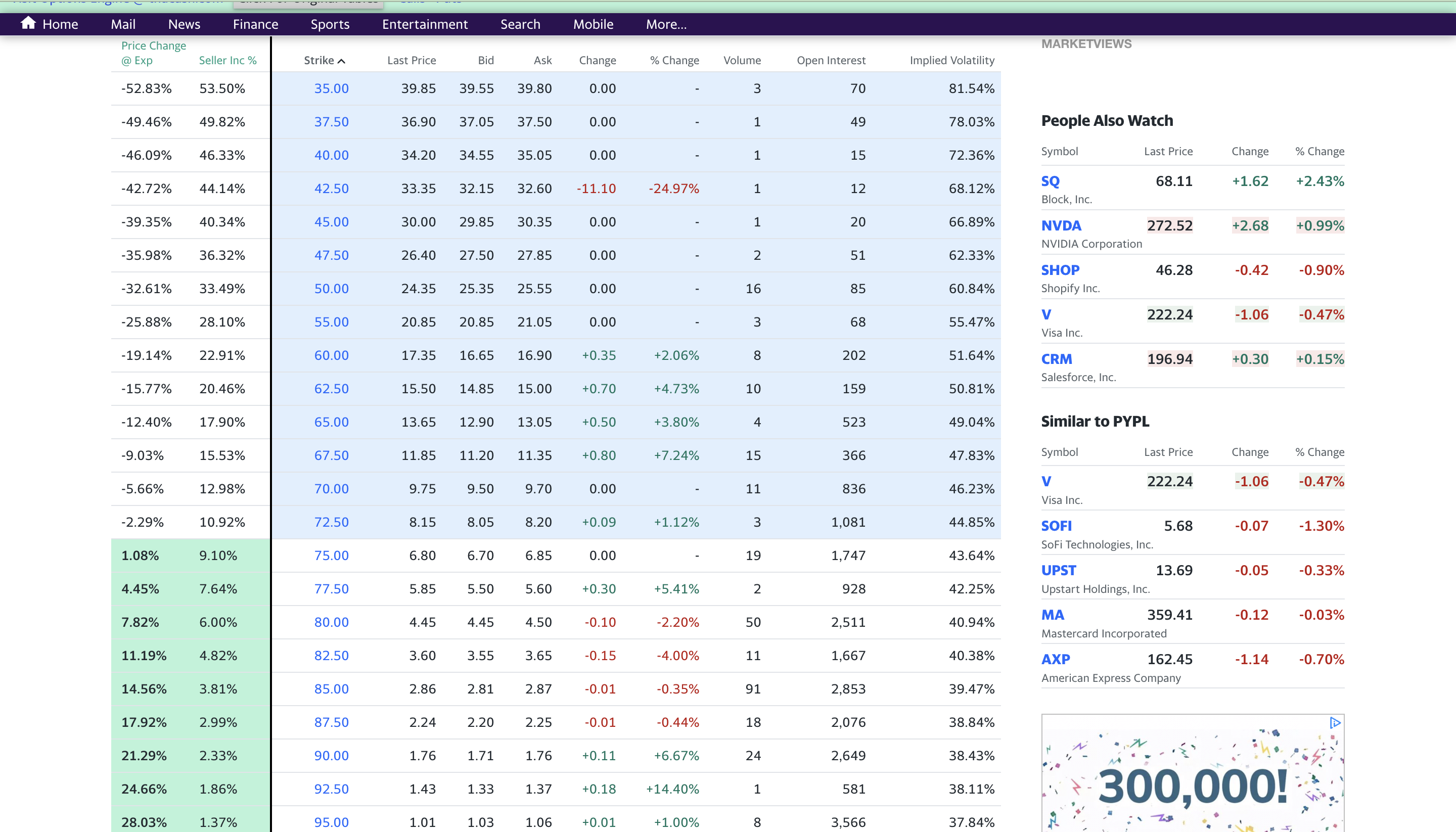

Percent Change @ Exp

For each row in the options chain, Options Engine calculates the Percent Change @ Exp.

The Percent Change @ Exp is the change in stock price between the strike price and the current price as a percentage of the current price.

This is so you know how much and in which direction the current price needs to move during the contract period to equal the strike price.

The formula is the following.

Percent Change @ Exp = (strikePrice - stockPrice / stockPrice) * 100

Options Engine also highlights in green the rows that are interesting to options sellers based on that percentage calculation.

Seller Inc %

For each row in the options chain, Options Engine calculates the seller income percentage based on the average of the bid and ask prices as a percentage of the current stock price.

This is so you know the value of the contract price in relation to the current value of the underlying stock.

The formula is the following.

Seller Inc % = (avgBidAskPrice / stockPrice) * 100

We are adding more features, so please reach out with any ideas you have.

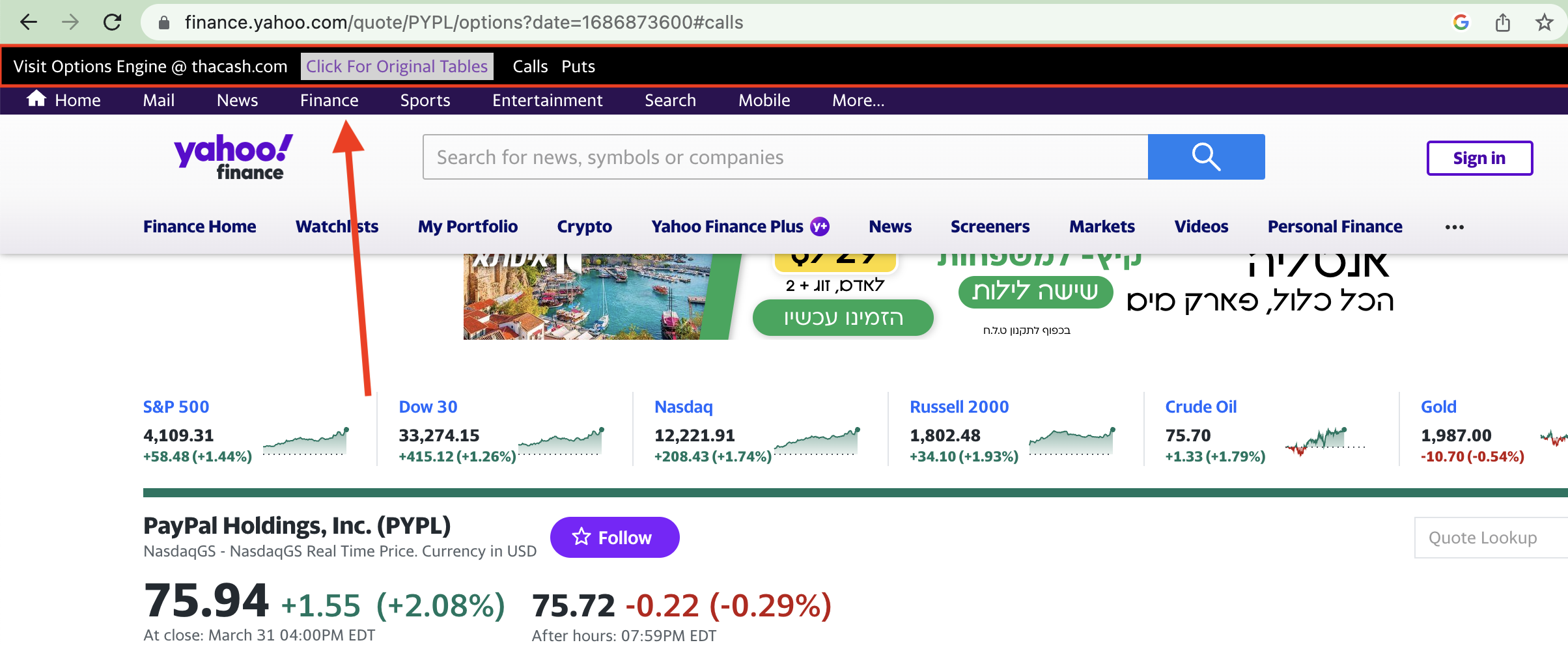

What It Looks Like

This is an example of the table with Options Engine.

This is an example of the table without Options Engine.

Options Contract Convenience Features

Options Engine also offers convenience features to save you time and hassle. These features reduce scrolling, refreshes, and clicking that you have to do.

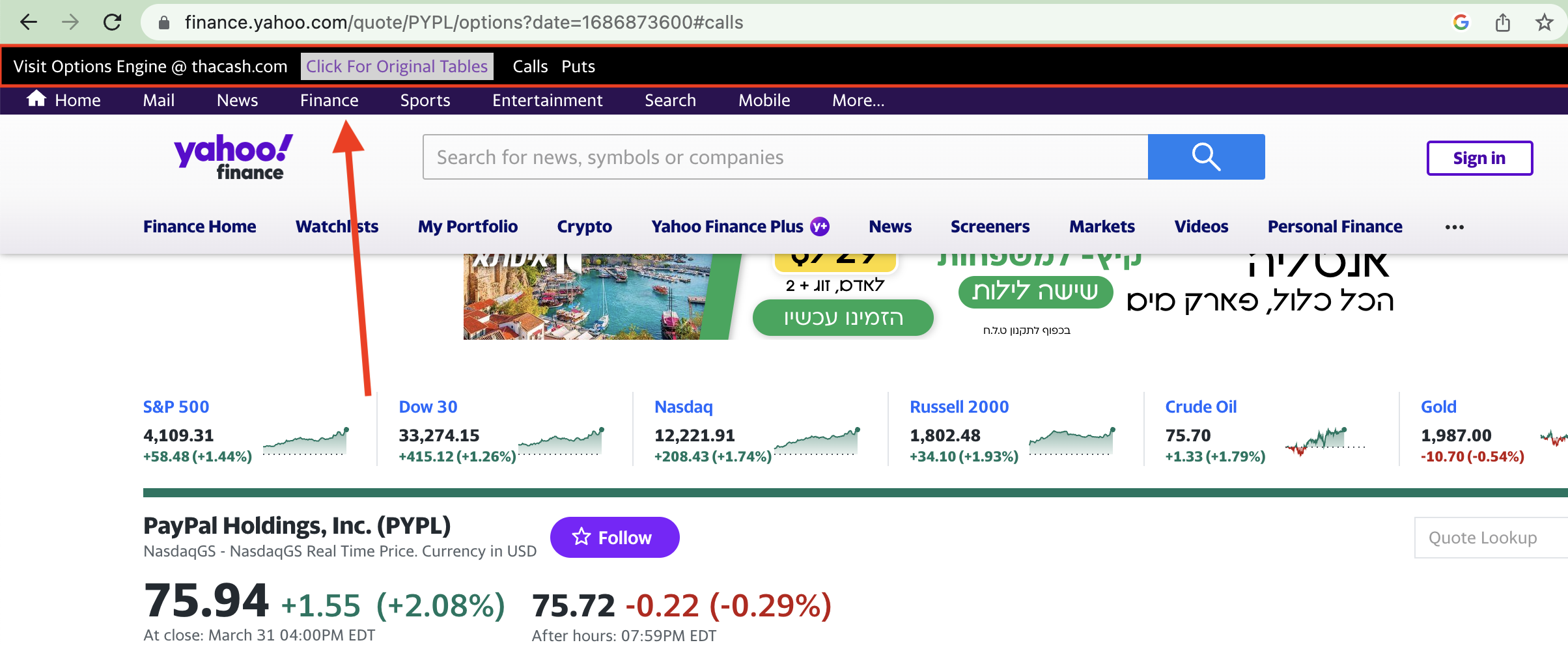

The Options Engine Bar contains a button for toggling the Options Engine features in the options chain tables on or off. The bar also has quick links to the calls and puts tables in addition to our website where you can subscribe to our options newsletter.

We also put the current price in the browser's tab so that you can see it even while you have already scrolled past the price to look at the options chain tables.

Even with the price in the tab, you can still see which company you are viewing in the url.

With no price in the tab, you have to scroll or click to find the price while viewing the options chains and you get duplicate information between the tab and the url.

This is an example of the browser tab without Options Engine.

Look for other convenience features as we continue to build out the extension.

Free to Use Options Engine

The Options Engine extension is free to use. Simply download it from the Chrome Web Store and start using it.

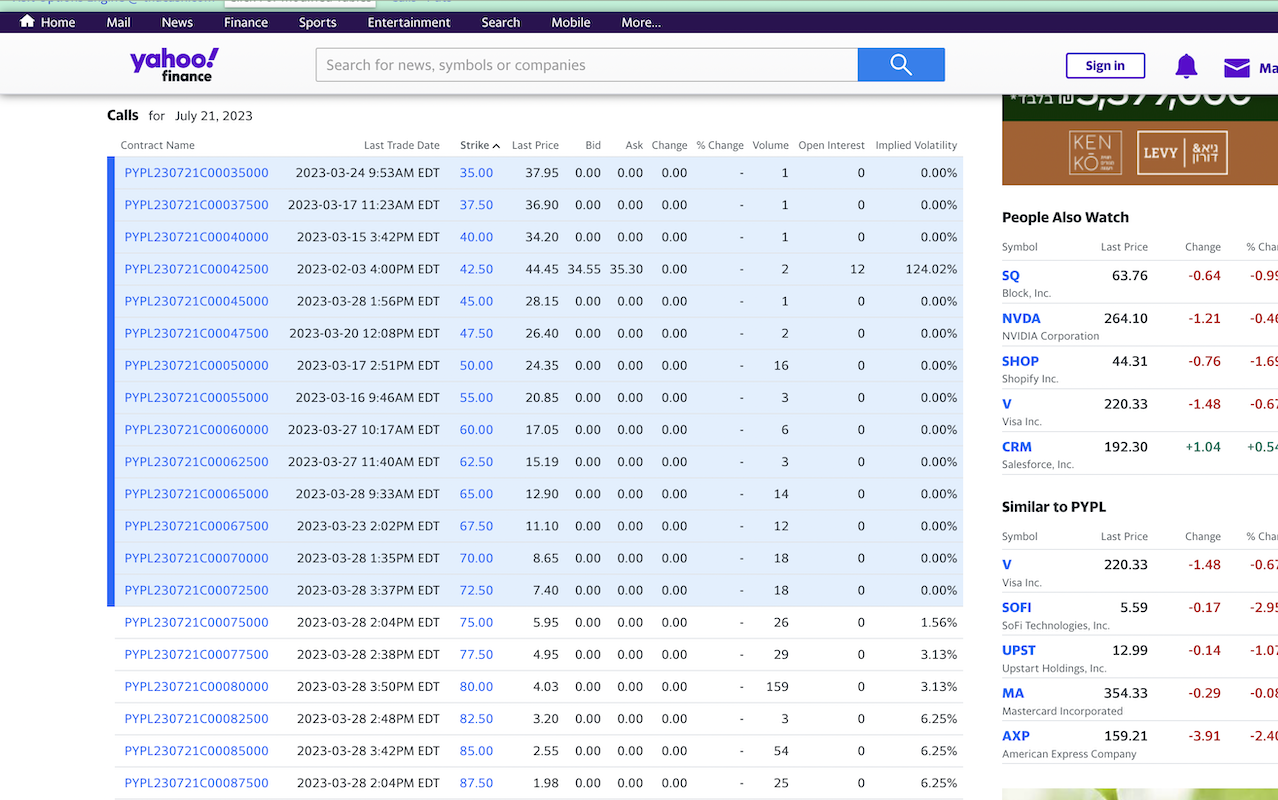

How to Use Options Engine

Visit the Google Chome Web store to install Options Engine by adding it to Chrome.

After adding Options Engine to Chrome, visit a Yahoo Finance options page to use Options Engine.

Here is an example options page on Yahoo Finance.

Look for the Options Engine bar at the top of the page. Click the button in the Options Engine bar to put the extension to work.

Then look at the calls and puts options chains tables for the additional columns added by the Options Engine extension.

The Options Engine bar has links to those tables for your convenience.

Options Engine and ThaCash Do Not Provide Financial Advice

Options Engine and ThaCash do not provide financial advice.

You should do your own independent research and analysis and seek the advice of professional financial advisors before buying or selling any securities, including stocks and options.

While Options Engine and ThaCash strive to do their best to provide accurate, timely, and reliable information, Options Engine and ThaCash cannot guarantee that its information is accurate, timely, or otherwise reliable.

Therefore, you should not rely on Options Engine, ThaCash, or any of their related properties for making financial transactions.

Options Engine and ThaCash are not responsible for any of your investment outcomes or returns. Please do you own research, make your own decisions, and be a responsible investor.

Options Engine Extension Does Not Collect Or Store Your Data

The Options Engine Chrome Web Extension does not collect or store your data. ThaCash may collect data and use it accorinding to the Terms and Privacy.

Options Engine Is Independent

Options Engine and ThaCash are not affiliated with Yahoo or any financial institution. We are independent. Options Engine is a product made by and for ThaCash website.

Search for Options Trading Learning Resources

Option Strategies for Directionless Markets: Trading with Butterflies, Iron Butterflies, and Condors

The Reverse Iron Condor Options Trading Strategy: A Prudent Non-Directional Options Trading Strategy

Rolling Stocks and Covered Calls: Two Powerful Investing Methods For Riding the Stock Market's Waves

Options Trading the Hard Way: A Trader’s Guide to Tactics & Strategies for Successful Option Trading

Options Engine Contract Calculator on Wikipedia

Exploring #ArtificialIntelligence for #Finance like #finbert #AI models that predict #sentiment and #classify financial text. https://t.co/IX766rTg0A

— thacash (@thacash_club) May 15, 2023

What finance AI do you know about? #buildinginpublic #markets #stocks #news #code #coveredcall

How do you like to use the time value of an option contract when you sell? When do you prefer short, medium or long expiration dates? #Optionselling #OptionsTrading #calls #puts #buildinpublic

— thacash (@thacash_club) May 5, 2023

Agreed. It’s better to have the tax problem than not. It means you’re making money!

— thacash (@thacash_club) April 28, 2023

BOUGHT $MSFT 4/28 302.5C NOW TRADING AT $1.14🚨

— EliteOptionsTrader (@EliteOptions2) April 26, 2023

#meta is up 14% right now! $META up at least 7% around April 27 each of the last 3 yearshttps://t.co/GiXBX3IzwD

— thacash (@thacash_club) April 27, 2023

I put a little chart together that might help for the next 90 days. pic.twitter.com/Ebv2HxvMpr

— thacash (@thacash_club) September 20, 2022

Dividends

— The Options Geek (@The_OptionsGeek) April 23, 2023

+

Options selling income

=

Dividend on steroids

That’s awesome. One thing to look out for. As your applications grow in size, it might get confusing to have a mashup of css approaches. Staying super organized can help. Regardless, keep going 💪🏼💪🏼!

— thacash (@thacash_club) September 20, 2022

Options trading is often misunderstood as a form of gambling, but that couldn't be further from the truth.

— The Options Geek (@The_OptionsGeek) April 18, 2023

It's a legitimate strategy for wealth-building and it that can offer significant rewards for those who approach it with discipline and a long-term perspective.

5 Ways to Earn Money from AAPLhttps://t.co/2nOMwQ4caz #aapl #stocks #StocksToBuy #dividend #OptionsTrading #Optionselling #investing #savings #savingsaccount #money #calls #puts

— thacash (@thacash_club) April 26, 2023

Look at how $MSFT did the last 5 years in the 3 months before and after today.https://t.co/swuQqsJuCc pic.twitter.com/xztQVCR1fb

— thacash (@thacash_club) April 27, 2023

Here is the #TSLA price table for last year for the days surrounding Apr 27 last year.

— thacash (@thacash_club) April 27, 2023

Check out more at https://t.co/baq5GMfBAn pic.twitter.com/dxci2kLqTf

Thanks for sharing @WealthCoachMak. I’ve had similar happen with $MELI years ago. Not a good feeling even though looks like you still made good money overall. Keep on going 💪🏼

— thacash (@thacash_club) May 19, 2023

I'm pleased to announce the official launch of Options Trading Academy: Advanced.

— Kiakili 🌍 (@kiakiliX) April 24, 2023

Designed to unlock your true potential as an elite options trader, I will teach a deep understanding of elite charting techniques, strategy combos, and AI trading tools to increase profitability. pic.twitter.com/pvphj933BT

The most positive and most negative daily percentage moves by year for $TSLA stock price in the days surrounding Apr 27 for each of the last 5 years.https://t.co/baq5GMfBAn pic.twitter.com/awRWIAIr2S

— thacash (@thacash_club) April 27, 2023

Sell covered calls. Check out my options calculator at https://t.co/2kRxOdxppR. Dividends + selling covered calls + stock price increases can be a great combination to get more cash to buy shares and also get the stock upside

— thacash (@thacash_club) April 27, 2023

Same here, but NextJS.

— thacash (@thacash_club) September 20, 2022

Super duper pumped to see @elonmusk making moves @Twitter. #wesupportelon Can’t wait to see him and his team transform the company. Did you see what his Tesla engineers presented at their AI day this year? They are a talented bunch. #theultimatemaker

— thacash (@thacash_club) November 3, 2022

Forms are fun! They can be endless at times though. Keep with it. Eventually you will feel like a form ninja 🥷

— thacash (@thacash_club) September 20, 2022

Good luck! $SQ price tends not to drop around 90 days following May 2. See photo for last 5 years. The 14-day performance might be different though. https://t.co/h8jIH5pwPD pic.twitter.com/Aiz60Chx1i

— thacash (@thacash_club) May 2, 2023

💵 To make $500 per month from dividends...

— The Income Investor (@incomeinvestor_) April 28, 2023

You'd need over $100,000 invested ☑️

But if you wanted to make the same $500 per month 💲

You could do that with ~$20,000 in capital to sell options 🏦

The markets feel strong. Do you think it’s a good time to sell puts that are close to the money for stocks that are hot? #Optionselling #OptionsTrading #calls #puts #buildinpublic

— thacash (@thacash_club) May 5, 2023

Excellent. How did you deploy it?!

— thacash (@thacash_club) September 20, 2022

#GoogleSheets and #NextJS Search Bar: The backend code and configuration https://t.co/lFfoT9st5d via @YouTube

— thacash (@thacash_club) December 5, 2022

thacash -- Covered Call Example: ~$200 in 3.5 months https://t.co/LAHsOmvGS0

— thacash (@thacash_club) March 30, 2023

What will @twitter 2.0 dev tools be like @elonmusk?!

— thacash (@thacash_club) December 5, 2022

6.17% Apr 13, 2020 roughly fourteen trading days before Apr 27

— thacash (@thacash_club) April 27, 2023

-7.56% May 5, 2022 roughly four trading days after Apr 27

The most positive and most negative daily percentage AMZN stock price moves in the days surrounding Apr 27 over the last 5 years.https://t.co/1NT7KeJTnm

Covered Calls & Cash Secured Puts Income this week (4/24 - 4/28):

— Coach Mak | Know Your Money (@WealthCoachMak) April 28, 2023

- Taxable: $1,690

- IRA: $627

🔥 TOTAL: $2,317🔥

- $AMZN: $558

- $TSLA: $414

- $DDOG: $299

- $GOOG: $294

- $AAPL: $150

- $TQQQ: $116

- $COIN: $108

- $SQ: $100

- $META: $96

- $SOXL: $91

- $JNJ: $63

- $SOFI: $28…

AI Stock Price Predictions For The Everyday Investor, by @thacash_club https://t.co/BxDXOh7g9S #stocks #investing #AI #software #fintech

— thacash (@thacash_club) April 28, 2023

https://t.co/aiveZJZtoS #coveredcalls #OptionsTrading #securedputs #calls #puts #stocks #investing

— thacash (@thacash_club) April 23, 2023

An #AI tool that is super powerful, everyone has free access to, that is not #ChatGPT, and that nobody talks about https://t.co/l16Z4tywVx#google #ai #googledocs #gmail #googlesheets #TensorFlow

— thacash (@thacash_club) April 28, 2023

#NextJS Search Bar With Category Buttons: Frontend Code Setup https://t.co/w84SypBVcw via @YouTube

— thacash (@thacash_club) December 5, 2022

Congrats! That’s awesome. Check out what I’m building at https://t.co/aA5tCKb0ep #buildinpublic

— thacash (@thacash_club) May 4, 2023

thacash: Secured Put Example https://t.co/z2TGEYVgAo

— thacash (@thacash_club) April 3, 2023

Check out my options calculator at https://t.co/2kRxOdxppR

— thacash (@thacash_club) April 27, 2023

How would you answer this: how much money you need to start selling options? Here is my answer: https://t.co/Joie6ZiRJ9#StockMarket #StocksToBuy #Optionselling #optionstrade #OptionChain #stockstowatch @themotleyfool

— thacash (@thacash_club) May 16, 2023

That’s awesome! Keep going.

— thacash (@thacash_club) April 30, 2023

If someone gave you $1M today, what would you do with it?

— EliteOptionsTrader (@EliteOptions2) April 25, 2023

What would you invest in?

I'll share what I would do with $1M later tonight, stay tuned.

Option selling tip 🚨

— Barely Legal Boomer (@Spazzin_Trades) May 1, 2023

Sell contracts on Friday

Use the theta decay over the weekend to burn your contracts.

Take profit Wednesday/Thursday.

Enter new cons Friday for the following week 🔁

In the last 5 years, $AAPL is UP EVERY YEAR at roughly 90-days after May 2. Good to know if you are selling #coveredcalls or #securedputs expiring 90 days from now. #AAPL #EarningsReport announced on May 4. Check out more #OptionsTrading at https://t.co/o3b0QB1kRW pic.twitter.com/NL9VQKoail

— thacash (@thacash_club) May 2, 2023

![OPTIONS TRADING CRASH COURSE [6 BOOKS IN 1]: The #1 Beginner to Advanced Guide. Learn the Strategies to Quickly Grow Your Account & Reduce Risk as a Top 1% Trader | Including BONUS on Crypto Options](https://m.media-amazon.com/images/I/517llJ3i-gL._SX384_BO1,204,203,200_.jpg)